How to Fill and Upload Form W-9 (For US Companies/Entities)

If you are a US citizen, a US resident alien, or a US-based entity (such as a Corporation, Partnership, or LLC), you are required to submit Form W-9 (Request for Taxpayer Identification Number and Certification).

Note: If you are NOT a US person or entity, do not use this form. You must submit Form W-8BEN (individuals) or W-8BEN-E (entities) instead.

Step 1: Download the Form W-9

You should always use the latest version of the form provided by the IRS.

Step 2: How to Fill Out the Form

Please follow the instructions below to complete the form. You can fill it out digitally or print it and fill it out with a black pen.

Line 1 (Name):

- Type your name as shown on your income tax return.

- Sole proprietors: List your individual name here.

- Entities: Input the name of the entity.

Line 2 (Business Name):

- If you have a business name, trade name, DBA name, or disregarded entity name different from Line 1, provide it here. Otherwise, leave it blank.

Line 3 (Federal Tax Classification):

- Select one box that applies to your tax status (e.g., Individual/Sole proprietor, C Corporation, S Corporation, Partnership, Trust/Estate).

- LLCs: If you are a Limited Liability Company, check the “Limited liability company” box and enter your tax classification (C, S, or P). Note: Single-member LLCs that are disregarded entities usually check the “Individual/Sole proprietor” box, not the LLC box.

Line 5 & 6 (Address):

- Fill in your mailing address (Street, City, State, ZIP).

- Important: This address should match the address in your JetHost profile to avoid confusion.

Part I: Taxpayer Identification Number (TIN)

- Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Individuals/Sole Proprietors: Generally, use your SSN.

- Entities/Corporations/Partnerships: Use your EIN.

Part II: Certification

- Sign Here: Sign the form (digital or hand-signed).

- Date: Enter the current date (MM-DD-YYYY).

Step 3: Upload the Form to JetHost

Once your form is completed and saved, follow these steps to upload it to your JetHost Affiliate Panel.

- Log in to your JetHost Affiliate Panel:

https://affiliates.jethost.com/affiliates/login.php#login

- Navigate to My Profile.

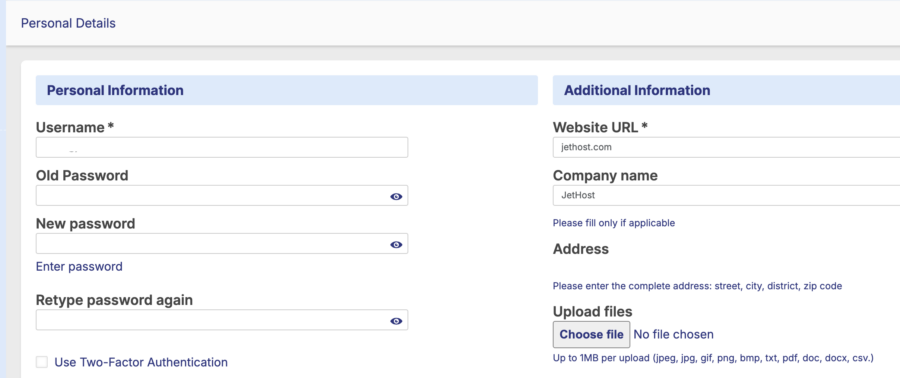

- Scroll down to the Additional Information section (located on the right side of the screen).

- Locate the Upload files area at the bottom of that section.

- Click the Choose file button.

- Select your completed W-9 file from your computer.

- Supported formats: jpeg, jpg, gif, png, bmp, txt, pdf, doc, docx, csv.

- File size limit: Maximum 1MB.

- Once the file is selected, scroll to the bottom of the page and click the Save Changes button.

Disclaimer: JetHost does not provide tax advice. The instructions above are a general guide based on IRS documentation. If you are unsure of your tax classification or how to complete the form, please consult a qualified tax professional.